I. The history of Ethereum upgrades

1. A brief history of Ethereum

Since the public mainnet (known as Homestead) was launched in July 2015, Ethereum has been upgraded four times: Homestead (March 2016), Metropolis Byzantium (October 2017), Metropolis Constantinople (February 2019), and Istanbul (December 2019). To sum up, these upgrades improved the functionality of Ethereum 1.0 and also laid the foundation for Ethereum 2.0. Click on the link below to find out more about the history of Ethereum:

https://consensys.net/blog/blockchain-explained/a-short-history-of-ethereum/

2. The specific upgrades

•PoS (Proof of Stake): PoS, an upgraded version of PoW, features enhanced security and scalability, as well as improved energy efficiency. PoW depends on miners and electricity; PoS, on the other hand, relies on validators (virtual miners) and ETH deposits to generate new blocks.

•Shard chains: Shard chains are a scalability mechanism that significantly increases Ethereum’s throughput of the blockchain while making it more energy-efficient. Shard chains “split” Ethereum by distributing the tasks of data processing among many nodes.

3. Before and after the upgrade

•The existing Ethereum network uses PoW and will switch to PoS after the upgrade. Here are the pros and cons of the two consensus mechanisms:

PoW | PoS | |

Pros | Decentralized | Time-saving |

More secure | Energy efficient | |

Cheat-proof | ||

Cons | Resource-wasting | Without addressing urgent business demands |

Poor performance | Subject to hacking | |

Overcentralized hashrates | Possible centralization in extreme cases |

•Before the upgrade, the network only supports about 30 transactions per second, resulting in delays and congestion. The upgrade, however, promises a maximum TPS of 100,000. It should be noted that the upgrade is still far ahead of us. In addition, Layer 2 may also exist as shards, and the TPS improvement will be still achieved through sharding.

4. How will the upgrade change Ethereum? What are its impacts on the existing Ethereum network?

The upgrade will improve the scalability, throughput, and security of the Ethereum mainnet. In addition, the merge and the upgrade will not clear any historical data, transaction records, or asset ownership on the existing PoW chain. After the upgrade, the original chain will keep running, and improvements will be made until it evolves into a shard chain of Ethereum 2.0.

5. When will the Ethereum upgrade be launched?

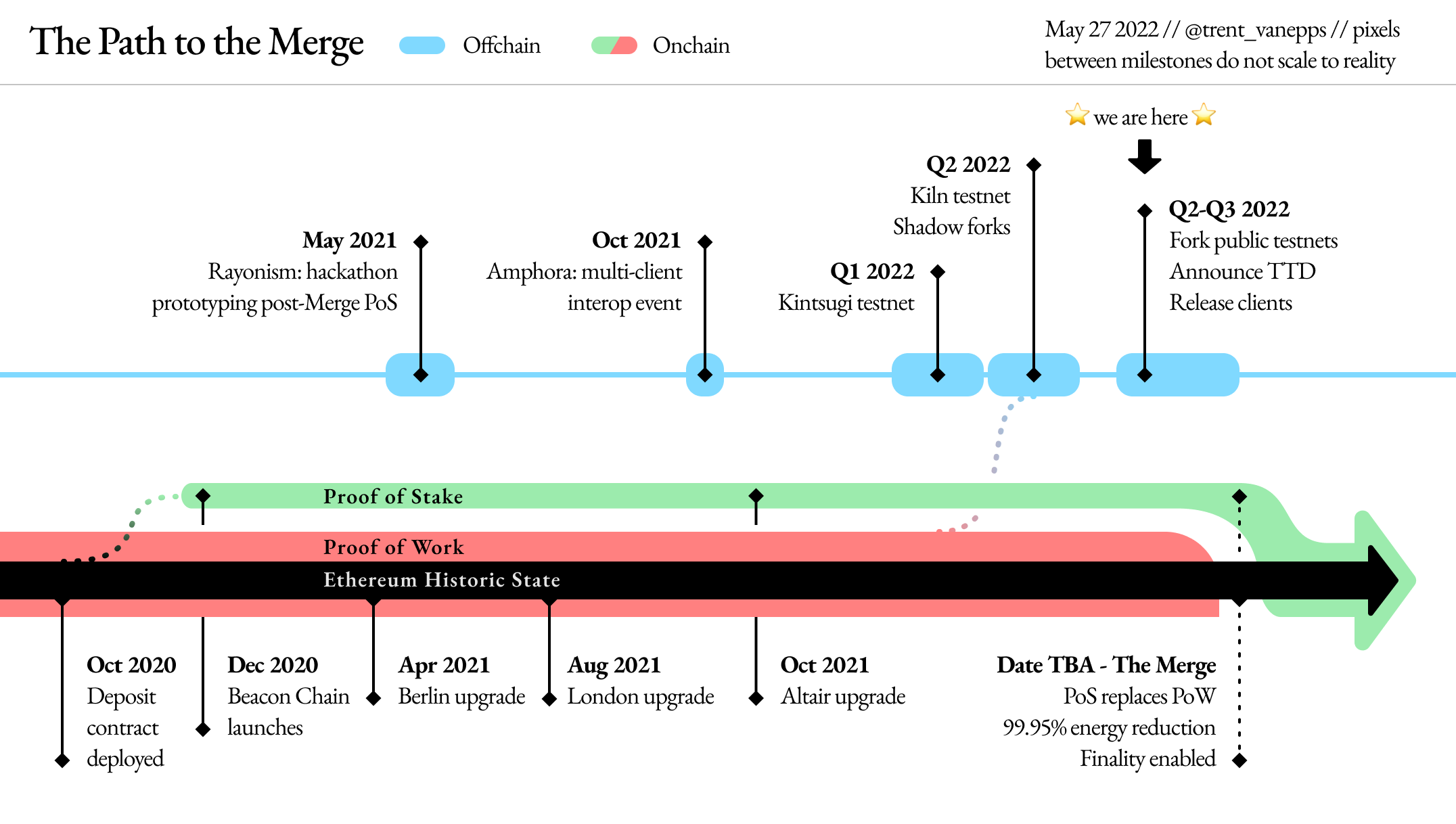

The Merge is no easy task. First scheduled for 2021, the upgrade has gone through multiple delays, which also signifies its significance.

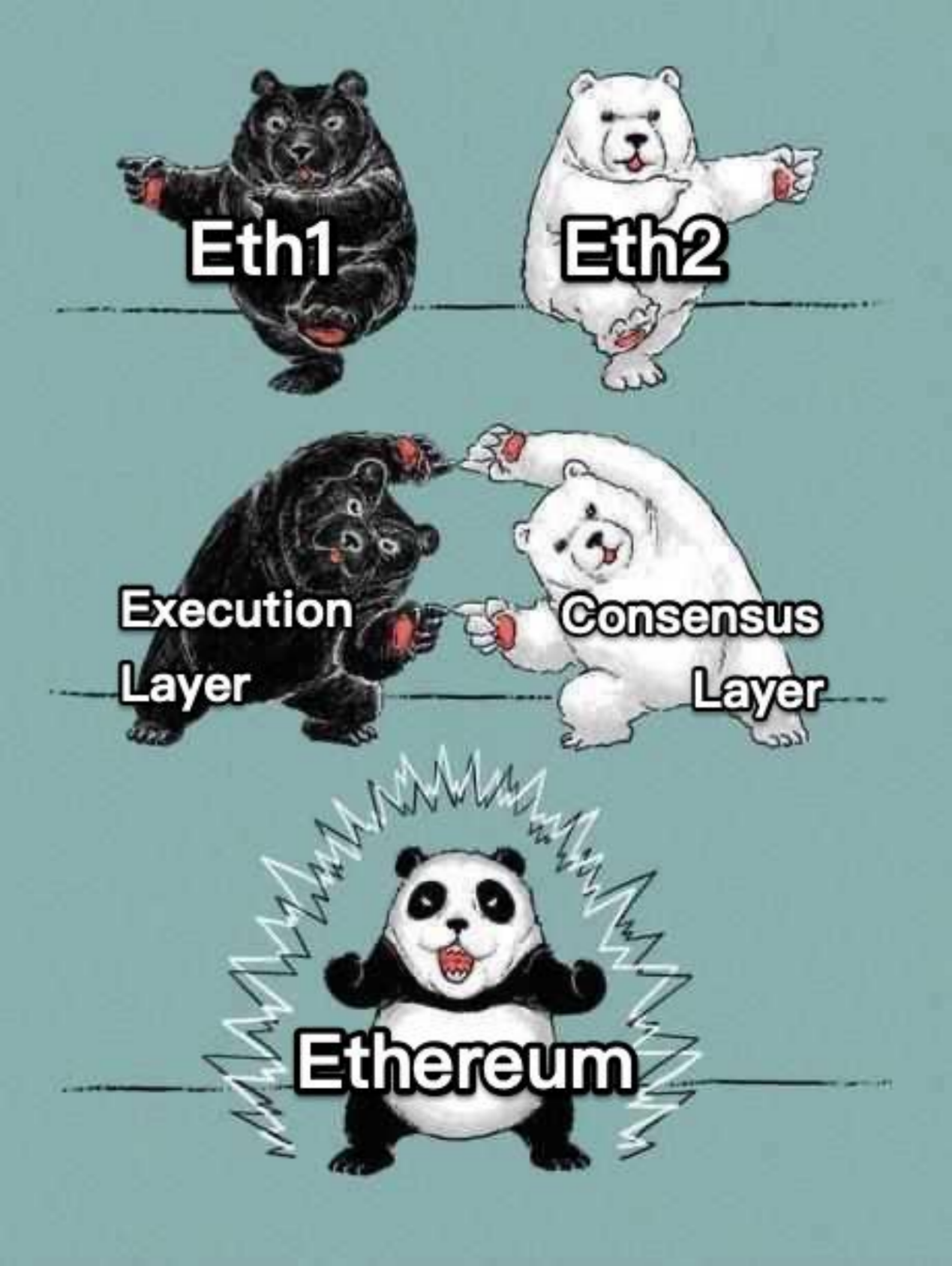

Over recent years, in addition to protocol development, we have also noticed a subtle change: Since last year, many Ethereum developers, including Vitalik Buterin, have started to use “Execution Layer” and “Consensus Layer”, avoiding any reference to “Ethereum 2.0” and “Ethereum 1.0”.

• Eth1 → Execution Layer

• Eth2 → Consensus Layer

• Execution Layer + Consensus Layer = Ethereum

II. The logic behind the Ethereum upgrade

Having introduced the whole history of the Ethereum upgrade, let’s now turn to its planning and current progress even though intermittent delays have occurred due to the extensive scope of the upgrade and development challenges. Learning about the planning and modules of the upgrade will help us capture the growth trend of the entire network. Meanwhile, we could also identify some potential opportunities and new demands arising from the different stages of the upgrade.

Ethereum 2.0 consists of a set of upgrades that aim to improve the scalability, security, and sustainability of the network. Although each upgrade works in parallel, they have certain dependencies that determine their deployment data. In short, the Ethereum upgrade is divided into three aspects: the Beacon Chain, the Merge, and Shard Chains. According to the official website, the latest upgrade date is June 3, 2022.

1. The Beacon Chain (December 1, 2020):

The Beacon Chain doesn't change anything about the Ethereum we use today.

a.It will coordinate the network, serving as the consensus layer;

b.It introduced Proof of Stake to the Ethereum ecosystem;

c.At the time, it was called “Stage 0” of the technology roadmap.

The Beacon Chain introduced PoS to Ethereum. This is a new way to help keep Ethereum secure. Think of it like a public good that deposits 32 ETH via validators to activate validator software. This allows validators to participate in the network’s consensus, making Ethereum safer and earning them more ETH in the process. The Beacon Chain has existed as a separate chain from Mainnet (or the “Execution Layer”) since its genesis.

On the one hand, stakers don’t need energy-intensive computers to participate in a PoS system — a home computer or smartphone will suffice. This will make Ethereum applicable to more environments, and staking and becoming a validator will be more effortless than mining (the network’s current security strategy). On the other hand, the network gets stronger against attacks as more ETH is staked, as it then requires more ETH to control a majority of the network. To become a threat, you would need to hold the majority of validators, which means you’d need to control the majority of ETH in the system — that’s a lot! This will make Ethereum safer: the more participants there are in the network, the more decentralized and secure it becomes.

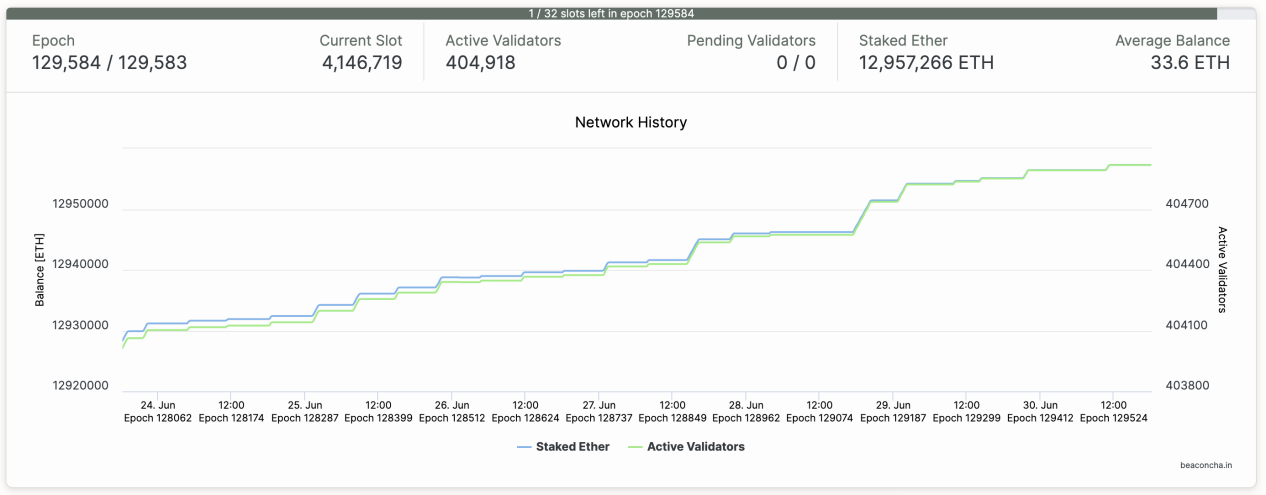

Therefore, under the PoS mechanism, the number of locked positions and validators, as well as the user-friendliness of the Staking network will boost the sound growth of the Ethereum network. As of June 30, the total amount of ETH staked stands at 13,610,817, with 404,918 validators staking at a rate of about 4.2%. Furthermore, the staking volume and validator community are both on the rise.

Both validators and users can stake ETH in different ways: solo home staking, staking as a service, pooled staking, or staking via centralized exchanges.

•Solo home staking: As its name implies, solo staking is the act of staking on Ethereum independently, without any intermediary delegators or agencies. As such, all protocol earnings belong to the individual running the node. In principle, solo staking is the most decentralized and also the most challenging staking method. In addition to depositing at least 32 ETH, solo staking also requires a dedicated computer for running an Ethereum execution client and ensuring the 24/7 operation of the node. To that end, you’ll need the following tools: Staking Launchpad (an open-source app that helps you become a staker); node tools such as Rocket Pool CLI, Stereum, Vouch + Dirk, Vouch + Dirk, eth-docker, Ethereum on Arm, and DAppNode; and Key Generators including Ethdo and Wagyu Key Gen.

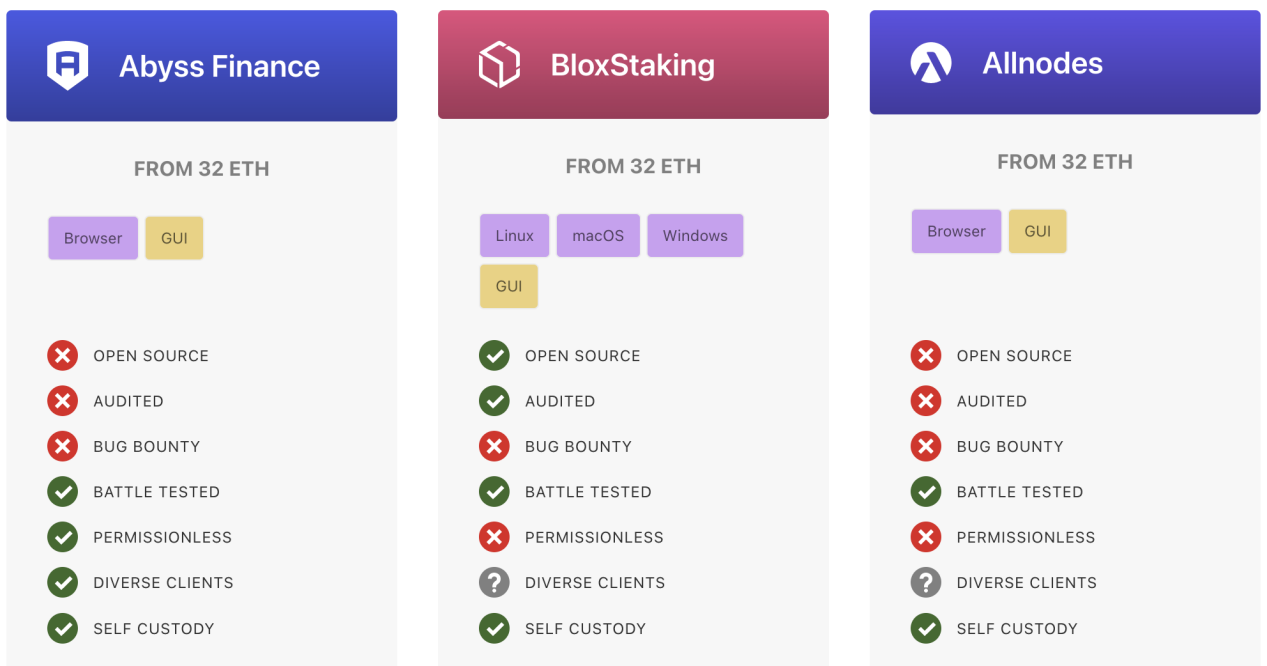

•Staking as a service (SaaS): SaaS represents a category of staking services where you deposit your 32 ETH for a validator, but delegate node operations to a third-party operator. The main purpose of using SaaS is to relieve yourself of the tedious task of running hardware and executing operations. Existing SaaS providers include Abyss Finance, BloxStaking, Allnodes, etc. They are also the delegator or partner of the various projects of the third staking method.

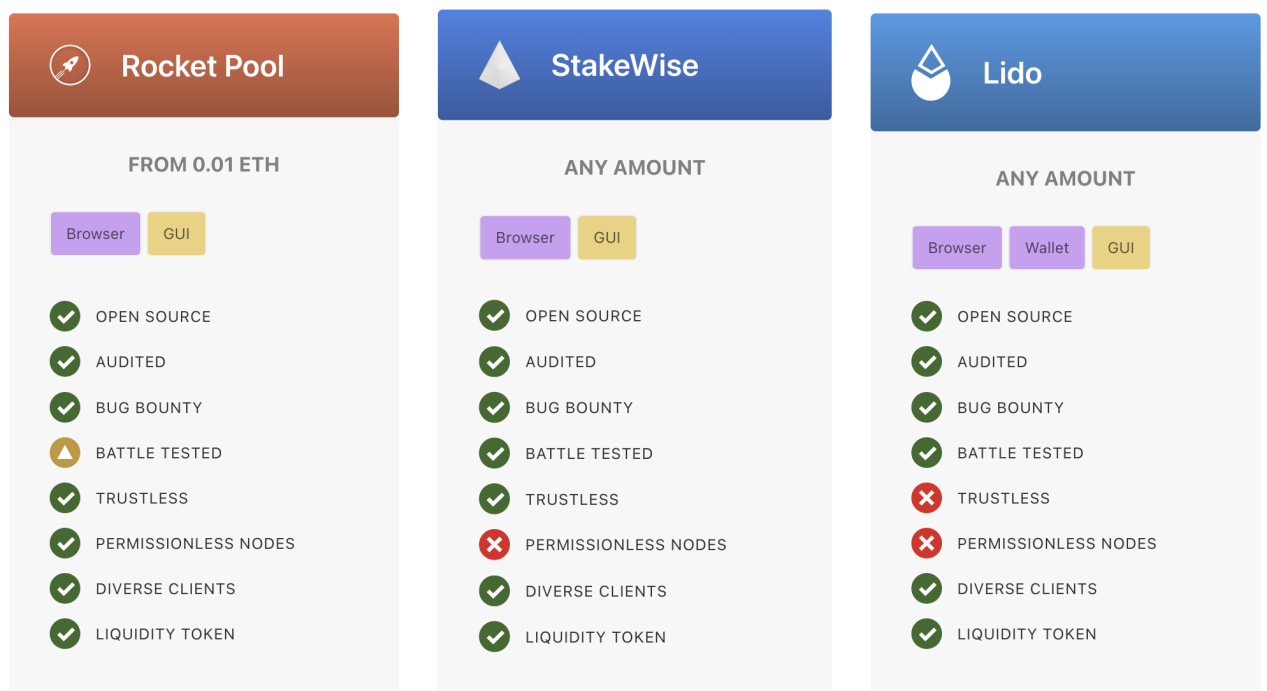

•Pooled staking: As it is convenient and meets the staking demands of regular users, pooled staking is also the most popular staking method at the moment that helps users who do not have or are unwilling to stake 32 ETH. Many of these options include what is known as “Liquid Staking” which involves an ERC-20 liquidity token that represents your staked ETH. Liquid Staking allows users to exit anytime effortlessly and makes staking as simple as a token swap. This option also allows users to hold custody of their assets in their own Ethereum wallets, such as Lido, Rocket Pool, and StakeWise.

For more information about Liquid Staking and its operating mechanisms, please refer to the following article:

https://medium.com/@ViaBTC_Capital/viabtc-capital-insight-liquid-staking-is-unleashing-the-assets-value-and-efficiency-3de47f5a894d

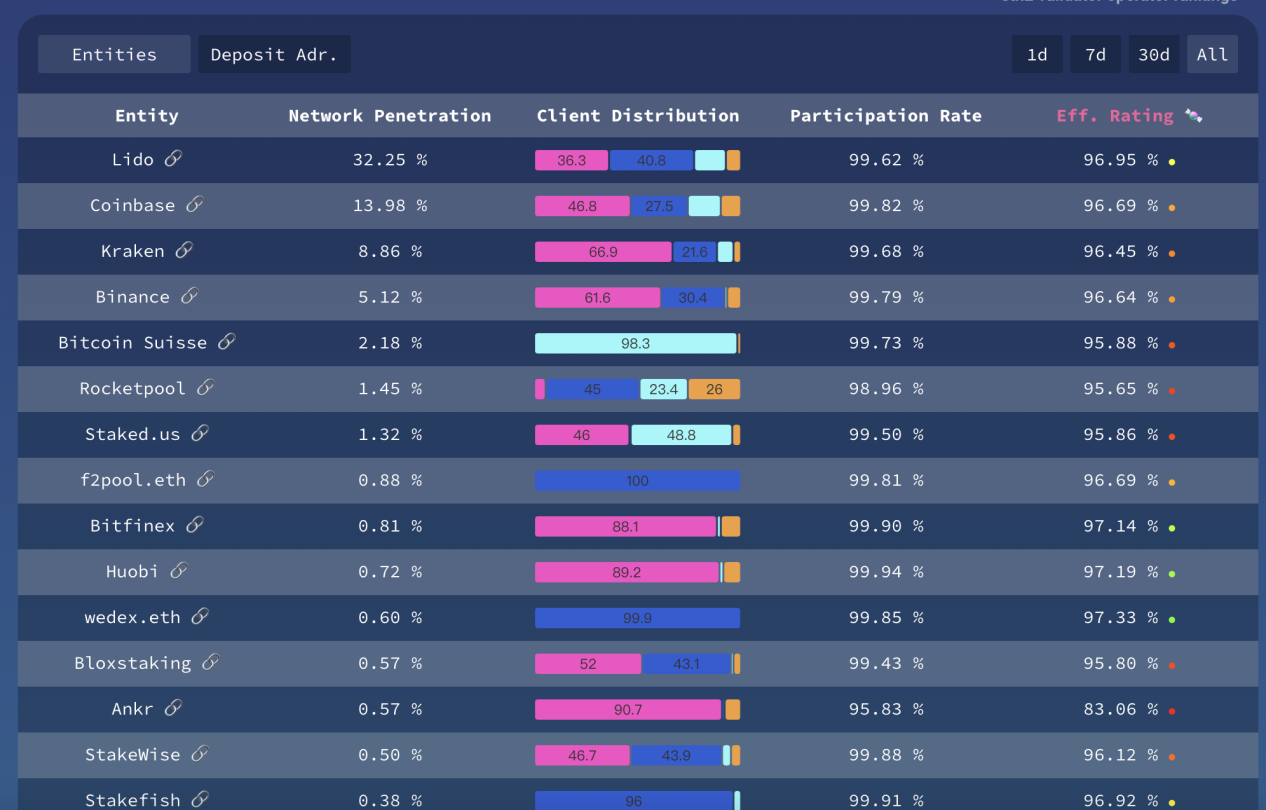

That said, when it comes to decentralization and security, we must remain careful about the centralization risks of the staking service providers. For instance, concerning the network penetration, Lido accounts for 32.25%, and centralized exchanges including Coinbase, Kraken, and Binance take up 27.96%. Additionally, unconfirmed addresses (others) occupy 30% of the network penetration.

According to https://pools.invis.cloud/, “validators on the Beacon Chain can choose from multiple different software clients, but the vast majority currently run Prysm. This is fine while Prysm runs faultlessly but in the event of a bug or attack, all the validators on the network would become victims of Prysm’s success. Having validators concentrated on one single client is a risk multiplier for individual validators and Ethereum as a whole.”

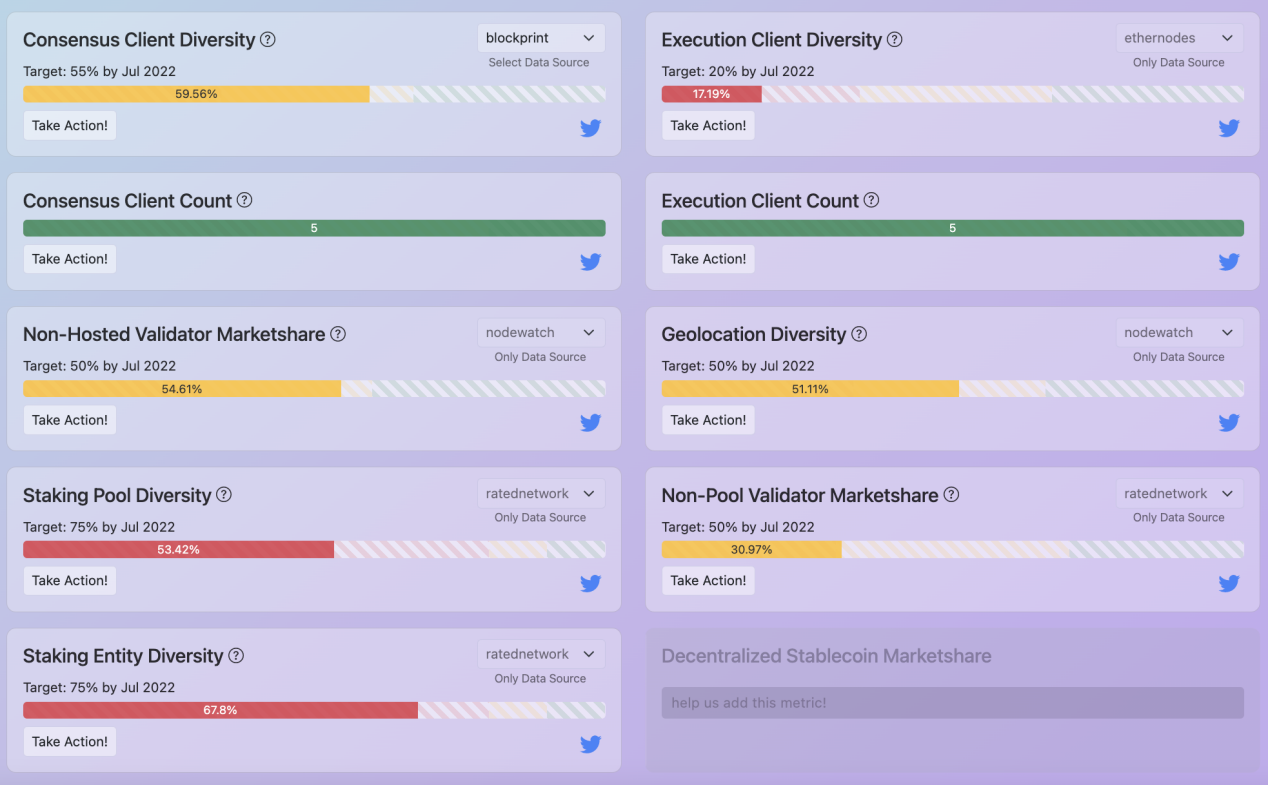

Meanwhile, data from ethsunshine.com shows that, in light of where Ethereum stands today, the diversity of consensus clients and execution clients need to be improved, and the market share of non-hosted validators remains low (validators relying on cloud hosting services are subject to sing-point failures or attacks, which could affect multiple validators). Moreover, the market share of non-pool validators is also low, a mere 30%. To keep Ethereum decentralized and healthy, there remains a lot to be done. For instance, the network could encourage solo staking or ask users of pooled staking to go for decentralized pools or use deposit their ETH via multiple pools. We hope that more competitors could enter the staking market, thereby creating a competitive market instead of an oligopoly.

2. The Merge (Q3/Q4 2022)

a.Ultimately, the current Ethereum Mainnet will merge with the Beacon Chain PoS system;

b.This will mark the end of PoW for Ethereum and the full transition to PoS;

c.The Merge had been in progress before shard chains were introduced;

d.The Merge is previously called “the docking”.

In his speech at the ETH & Shanghai summit, Vitalik Buterin said that the Merge on the Ethereum testnet Ropsten has been completed. If all things go according to plan, the mainnet merge will start in August. However, something did go wrong with the testnet merge, according to the latest testing and developer conference, which might postpone the mainnet merge.

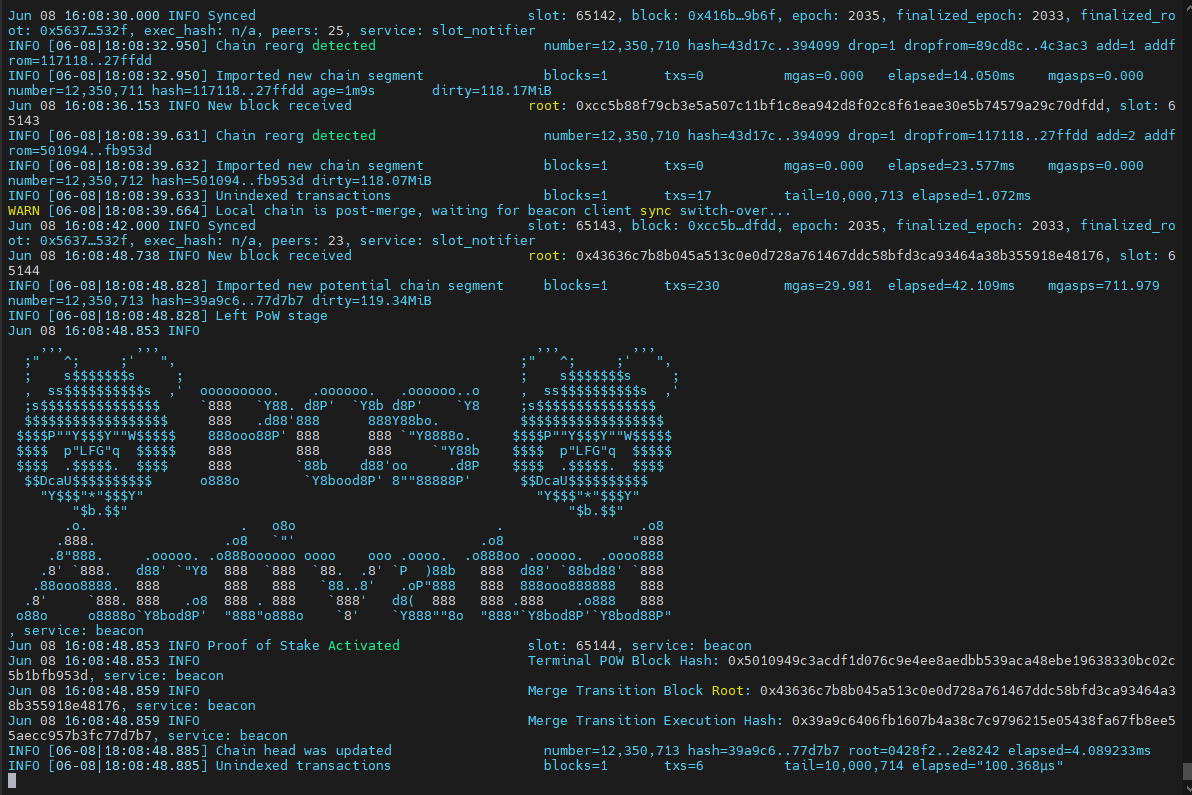

According to the latest news, the Ropsten testnet officially completed its Merge on June 9.

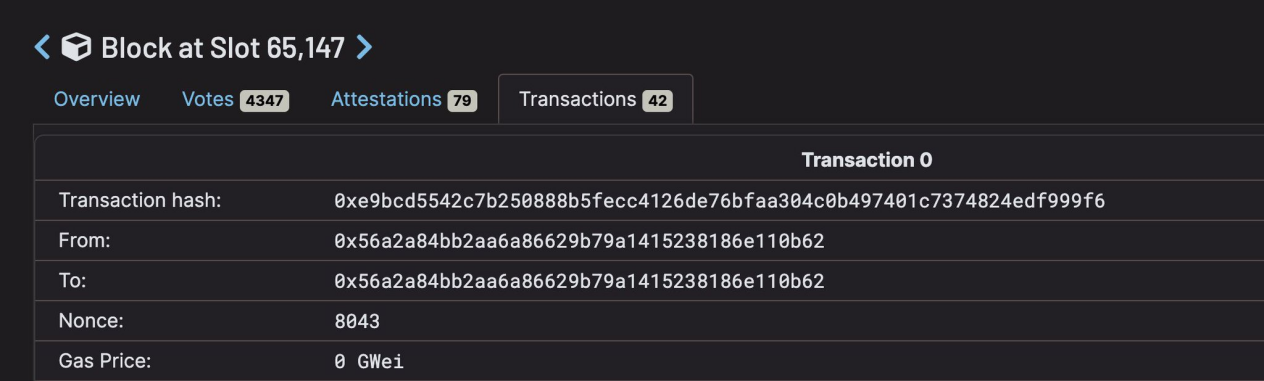

Transaction block DEMO of the Ropsten testnet after the merge:

(https://ropsten.beaconcha.in/block/65147#transactions)

Reminder: the Gray Glacier upgrade is scheduled for block 15,050,000, expected June 29, 2022

The Kiln Merge testnet, launched earlier this year, will be shut down shortly after the Ethereum mainnet’s transition to proof-of-stake.

Ropsten, Ethereum’s longest-lived proof-of-work testnet, has transitionned to proof-of-stake. It will be shut down in Q4 2022.

Rinkeby, a geth-based proof-of-authority testnet, will not transition to proof-of-stake and will be shut down in Q2/Q3 2023.

Users and developers are encouraged to migrate ASAP to Goerli or Sepolia to test Ethereum in a post-merge context. After The Merge, Rinkeby will not be a suitable testing environment for the Ethereum mainnet. Unplanned mainnet upgrades may no longer be applied to deprecated testnets.

Sepolia will be the second of three public testnets to run through The Merge.

The current Ethereum mainnet will “merge” with the Beacon Chain, becoming its own shard, and use PoS instead of PoW. The mainnet will bring the ability to run smart contracts into the PoS system, plus the full history and the current state of Ethereum, to ensure that the transition is smooth for all ETH holders and users. The Merge also marks the end of Ethereum’s PoW history and solves problems such as excessive power consumption. As Layer 2 improves and as technologies such as shard chains upgrade, the network will also address issues like network congestion and insufficient disk capacity, which marks another step in realizing the Ethereum vision – more scalability, security, and sustainability (the Impossible Trinity of blockchain).

3. Impacts of the Merge

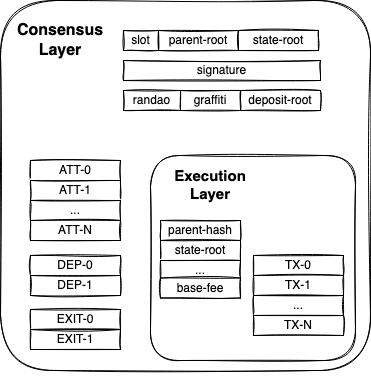

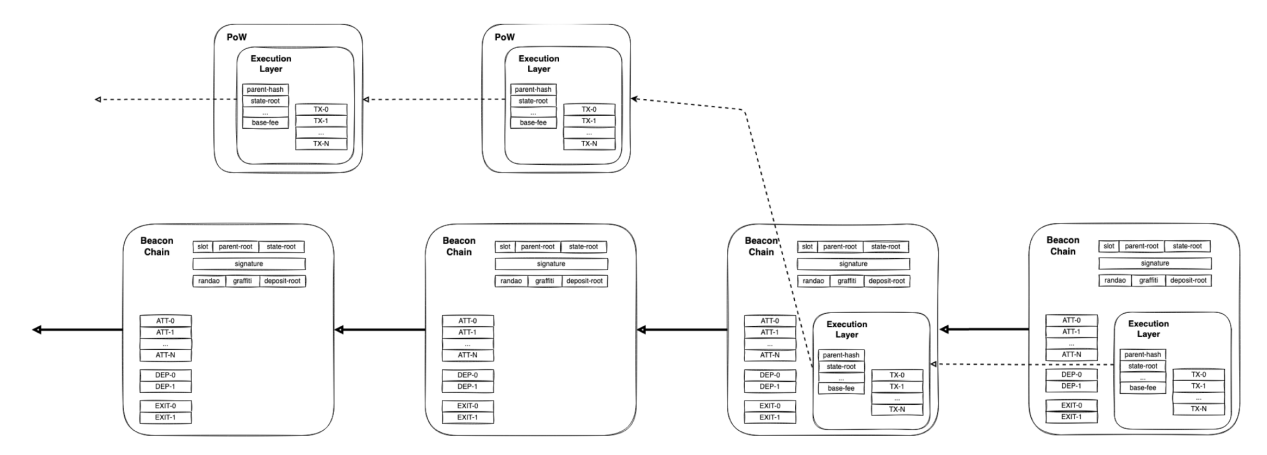

Architecturally, after the Merge, the current ETH1 and ETH2 clients become the Execution Layer and Consensus Layer (or engine) of Ethereum, respectively. This means that node operators of ETH1 or Beacon Chain clients will need to run the “other half” of the stack (the Execution Layer and Consensus Layer clients) to get fully validating nodes.

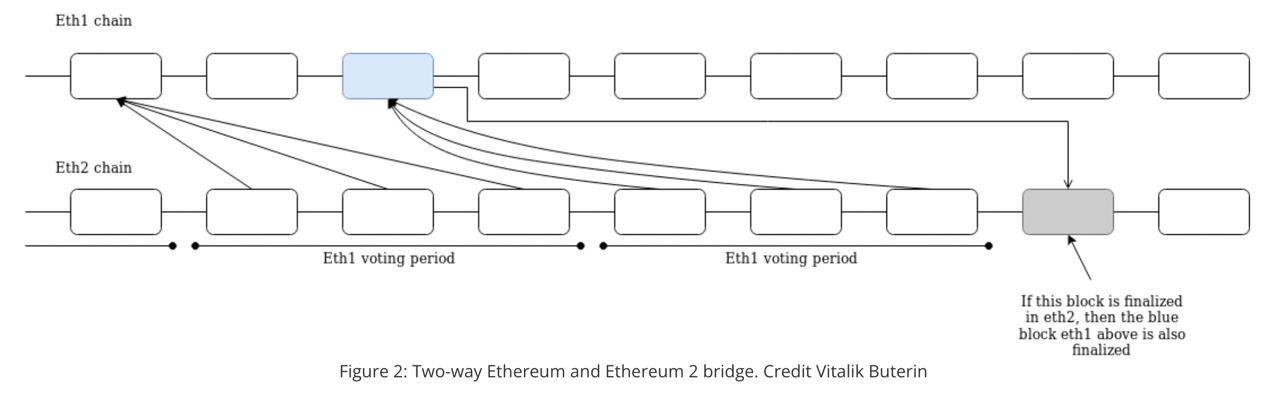

The Consensus Layer: After the Merge, PoW blocks will no longer exist on the network. Instead, they will become an integral part of the blocks created on the Beacon Chain. EIP-4399 also provides a way for on-chain applications to assess whether the Merge has occurred (https://eips.ethereum.org/EIPS/eip-4399) to enable seamless docking of existing applications. Here is the relationship between the Execution Layer and the Consensus Layer:

The Merge will bring Ethereum’s average block time from PoW’s theoretical figure of 13 seconds down to 12 seconds through PoS, a reduction of about 1 second. This should be considered by smart contracts that assume specific average block time in their calculations.

With safe heads and finalized blocks. applications no longer have to wait for new blocks to appear, as they had to with PoW, and may directly engage in confirmation or deletion.

A finalized block is one which has been accepted as canonical by over two thirds of validators. To create a conflicting block, an attacker would have to burn at least one third of the total stake.

Validators and users only have to combine their clients. Existing DApps will still interact in nearly the same way and will require minimal updates. The Merge will not solve scalability challenges right away but is set to pave the way for sharding to improve data availability and bandwidth. Rollups and L2 remain the best way to scale and lower gas fees.

According to the latest progress, a Terminal Total Difficulty (TTD) of 50000000000000000 has been selected for the Ropsten Merge. Stakers and node operators must manually override the TTD in both their execution and consensus layer clients before June 7, 2022. The Ropsten Merge has now been completed, and users will be able to withdraw their ETH staked via liquid staking, such as $stETH and $BETH, after the mainnet merge.

II. The logic behind the Ethereum upgrade

4. Sharding (2023)

•Sharding is a multi-phase upgrade to improve Ethereum’s scalability and capacity;

•Shard chains provide extra, cheaper, storage layers for applications and rollups to store data.

•They enable Layer 2 solutions to offer low transaction fees while leveraging the security of Ethereum.

•This upgrade is planned to follow the Merge of Mainnet with the Beacon Chain.

Sharding is the process of splitting a database horizontally to spread the load — it’s a common concept in computer science. In an Ethereum context, sharding will create new chains called “shards” to reduce network congestion and increase transactions per second.

The original plan was to study the shard chain before the Merge, which was aimed to address the scalability problem of Ethereum. However, due to the technical challenges and prolonged development cycle, and in light of the recent progress in the R&D of Layer 2 scaling solutions, the Merge took precedence over shard chains.

The Beacon Chain contains all the logic for keeping shards secure and synced up. It will coordinate the stakers in the network, assigning them to shards they need to work on. And it will also facilitate communication between shards by receiving and storing shard transaction data that is accessible by other shards. This will give shards a snapshot of Ethereum’s state to keep everything up-to-date.

Rollups are a Layer 2 technology that exists today. They allow DApps to bundle or “roll up” transactions into a single transaction off-chain, generate a cryptographic proof, and then submit it to the chain. This reduces the data needed for a transaction. Combine this with all the extra data availability provided by shards and you get 100,000 transactions per second. Rollups are not a temporary measure and will also coexist with sharding over the long run as a scalability solution.

According to the latest progress, EIP-4844 (Proto-danksharding) is a major breakthrough in the field of sharding. It is a solution designed to increase scalability by combining sharding with Layer2-Rollups to handle huge transactions. Previously, 64 shards correspond to 64 proposers, but in practice, this would lead to massive double confirmations, which results in market centralization. However, in Danksharding, only one proposer chooses to go into the slot and process all transactions and data. Projects such as Arbitrum, Optimism, StarkNet, Polygon, and Rollups can all greatly benefit from EIP-4844. Unfortunately, the proposal still cannot handle 16M data yet, but it can process 1M data, which is already a huge improvement.

For more information about Danksharding and the EIP-4844 proposal, please refer to the following:

https://www.eip4844.com/

5. The revenue model of ETH staking after the Merge

1) Fee will become a major factor

After the Merge, the revenue structure of Ethereum miners will consist of two parts:

•Rewards

•Fees

a) Let’s first turn to Reward:

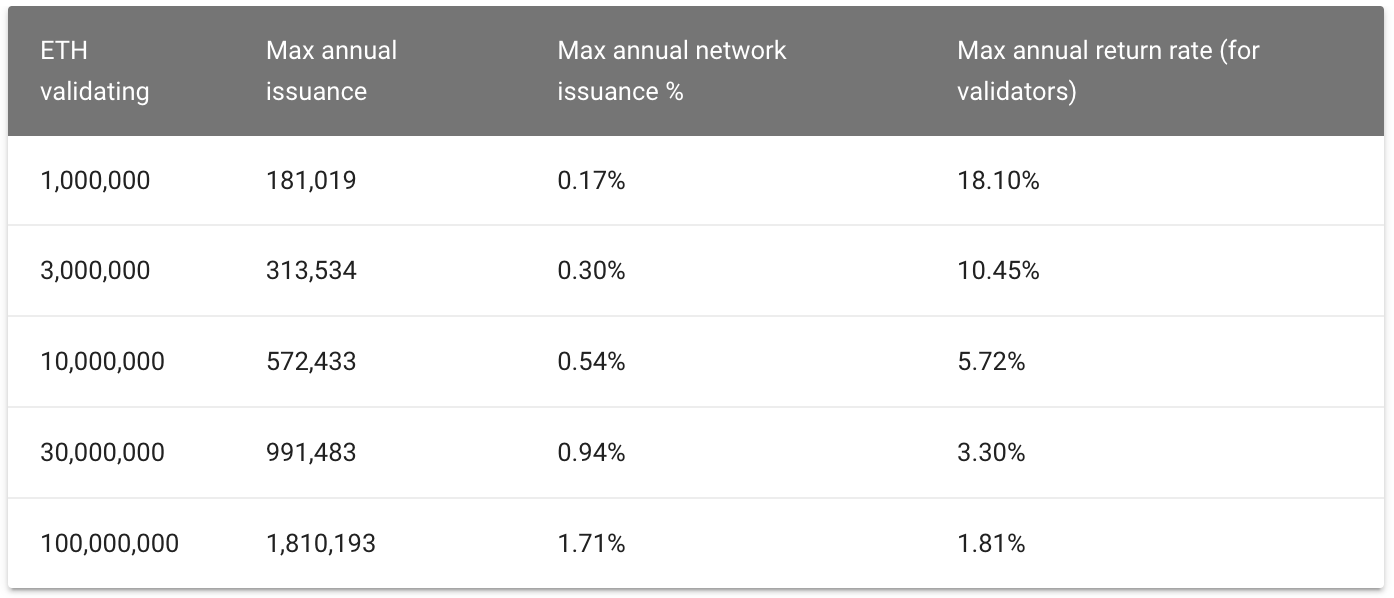

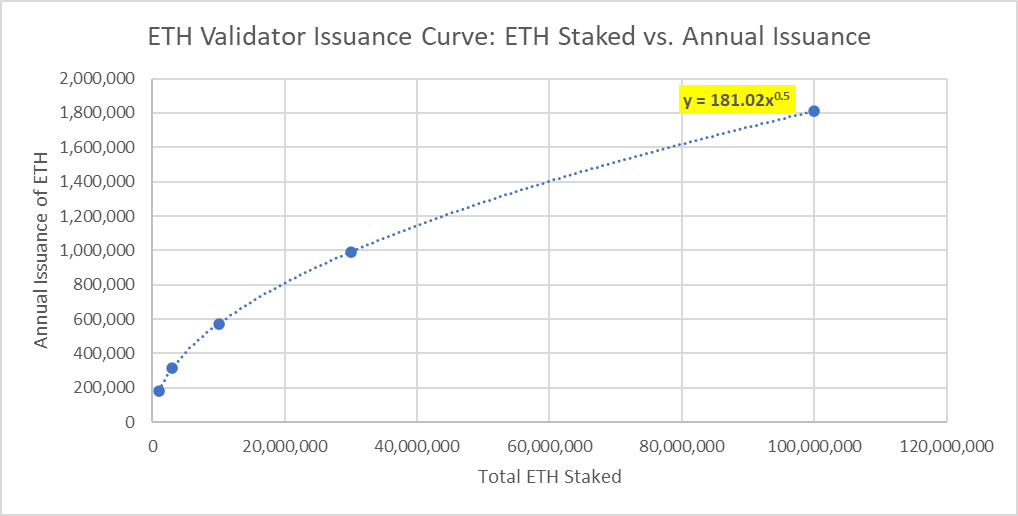

According to the schedule released by Ethereum’s official GitHub, given that the current staking amount stands at 12.8M ETH, the figure would roughly reach 15M upon the Merge. Based on that, the annualized Reward would be approximately 0.7M, an APY of 4.7%

Source: https://docs.ethhub.io/ethereum-roadmap/ethereum-2.0/eth-2.0-economics/

Source: https://docs.ethhub.io/ethereum-roadmap/ethereum-2.0/eth-2.0-economics/

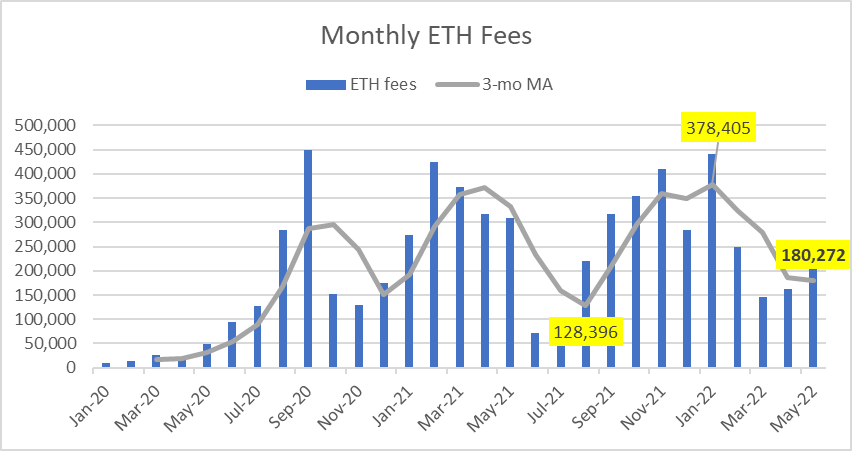

b) About 70% of fees that have gone through EIP1559 will be burned, and the rest will be distributed to validators:

Source: https://twitter.com/808_Investor/status/1532874044181200896/photo/1

2) The reward rate will decrease along with TVL after the Merge

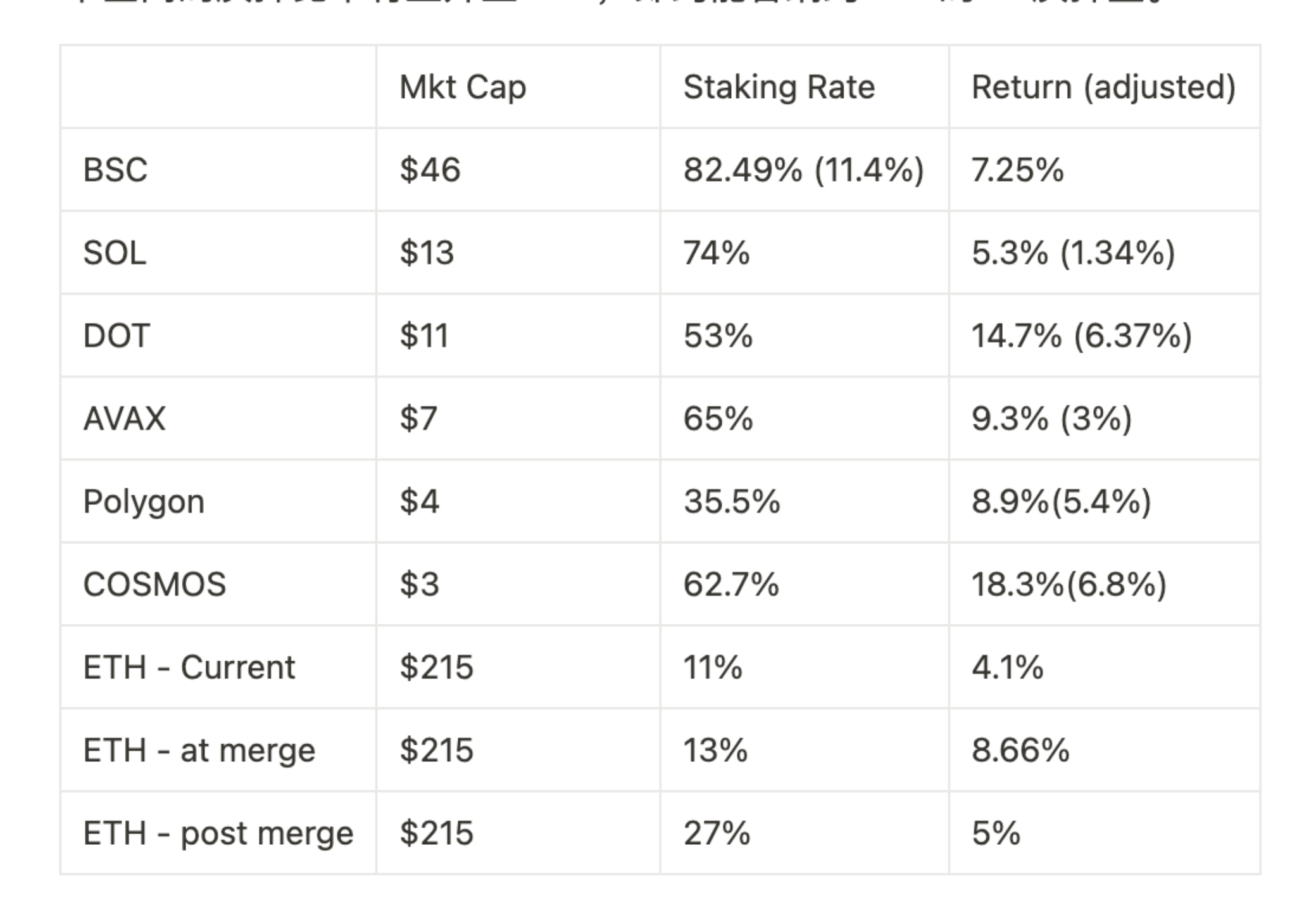

Compared with peers, the return rate of the Ethereum network will probably level out at around 5%. According to the average fees paid during the past 12 months, Ethereum’s staking rate would rise to 27%. In other words, it would be able to accommodate 32M ETH in staking.

Source: https://stakingrewards.com/

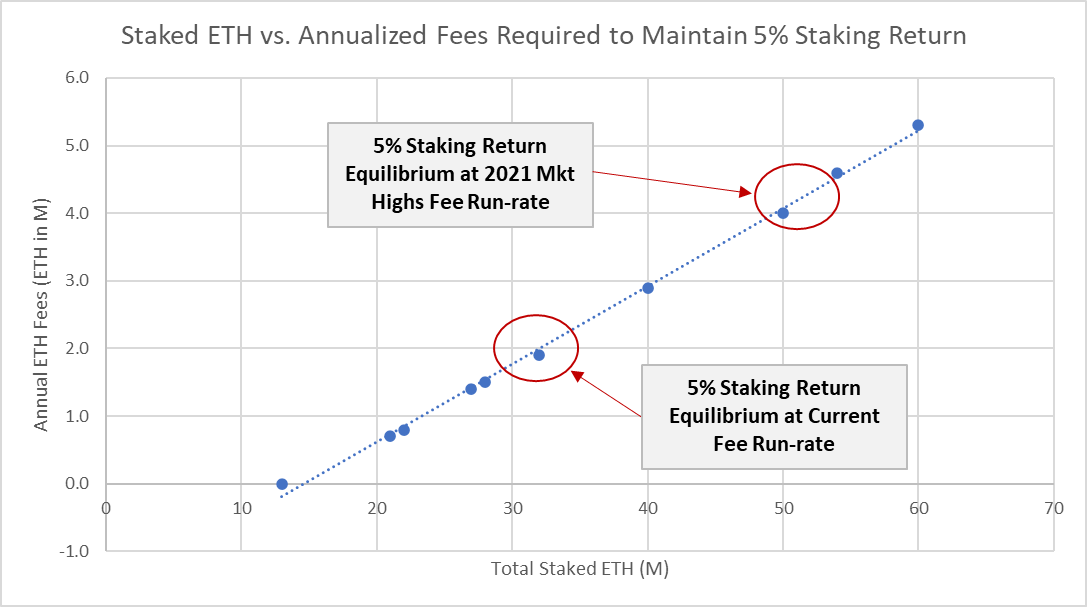

Let’s assume that 5% is the expected rate of return we need. Since the staking capacity of ETH is mainly affected by the network fee and reward, and as Reward is predictable, the reasonable expectation concerning fees should be the primary tracking factor. It is clear from the figure below that the fee revenue in 2021, the year when Ethereum was the most active, could cover 50M of ETH staked, which is 42% of the current scale.

Source: https://twitter.com/808_Investor/status/1532874067539263488/photo/1

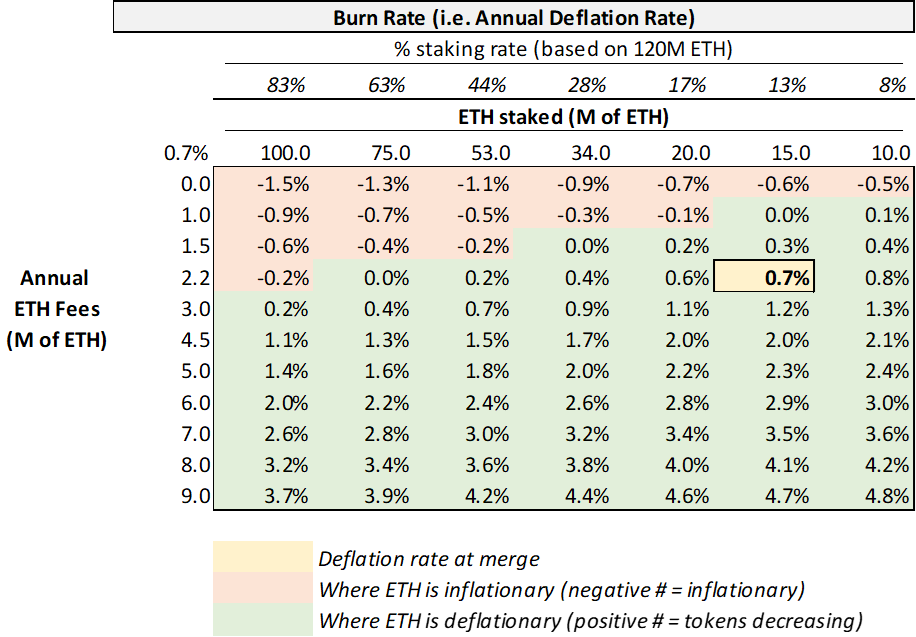

3) Post-merge deflation is very likely to happen

As calculated by Ethereum’s GitHub, if 30M ETH is staked, the network would have to distribute nearly 1M ETH as the reward. According to figures recorded in the past 12 months, the net burn stood at nearly 0.5M even in the month when the network was the most inactive, which gives us a deflation rate of 0.4%. Meanwhile, if the figure were to return to the level recorded in mid-2021, the deflation rate would exceed 1%.

Source: https://twitter.com/808_Investor/status/1532874071746220032/photo/1

Source: https://twitter.com/808_Investor/status/1532874071746220032/photo/1

III. Demands arising from the Ethereum 2.0 upgrade

If Ethereum successfully transitions to PoS by the end of this year, the Merge would bring huge changes to the network by next year. That said, what game-changing apps should investors focus on?

1. Staking pools

After the Merge, stakers on the network will begin to receive staking rewards. Users need to deposit 32 ETH to become validators, which will allow them to earn staking rewards while depositing the ETH to a lending protocol or DEX to make additional earnings. This will minimize the opportunity cost of staking. Meanwhile, staking pools allow retail users to combine their ETH holdings and become validators to share the reward. Notable projects: Lido Finance, Rocket Pool.

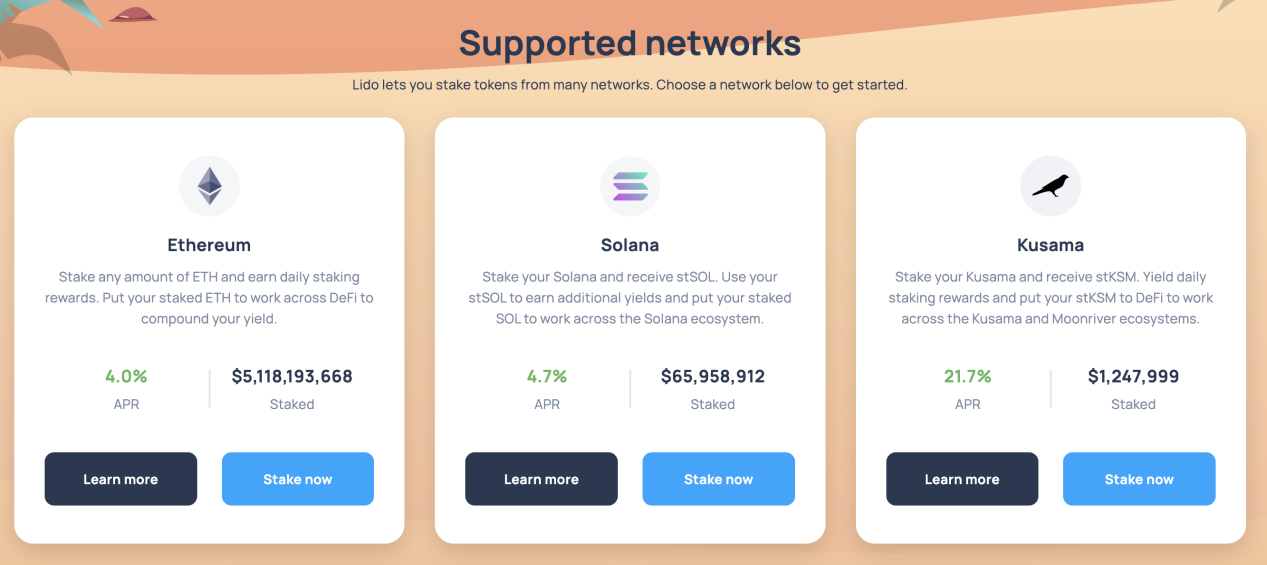

•Lido Finance (https://lido.fi/): the biggest staking pool

Though Lido Finance is now suffering from the panic caused by short-term market slumps and a spread between ETH and stETH, it is undeniable that liquid staking remains an effective incentive for PoS staking.

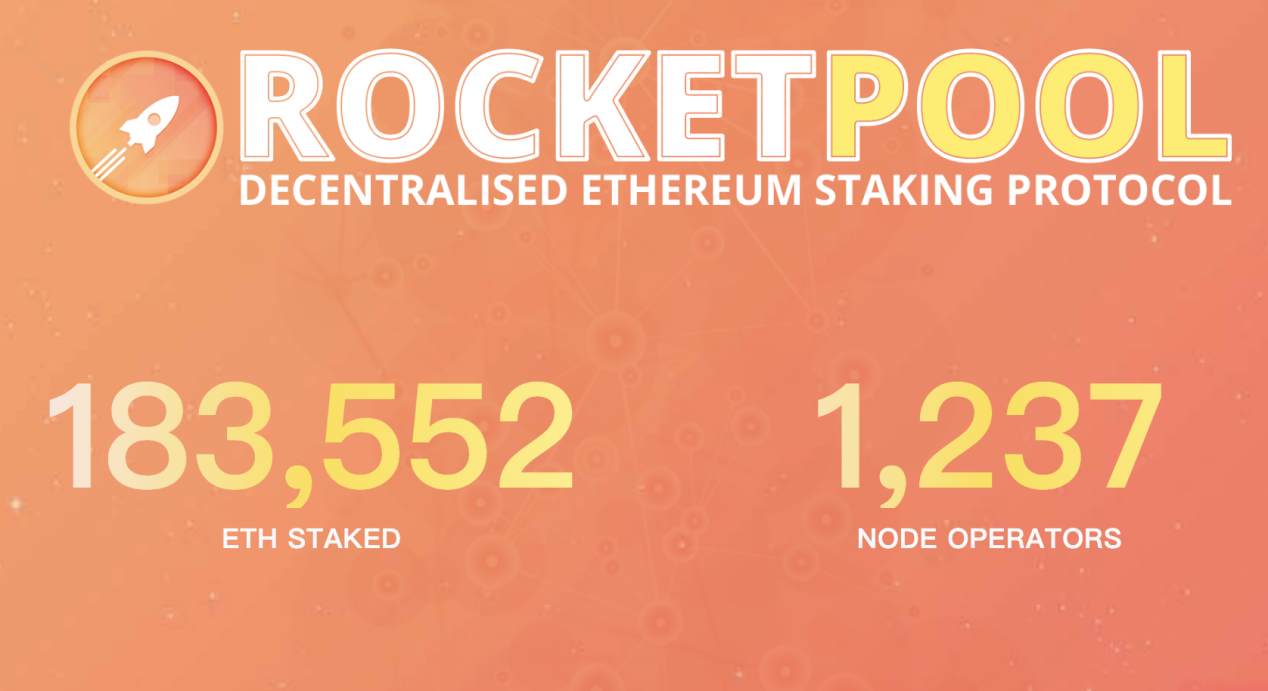

•Rocket Pool (https://rocketpool.net/): the second-biggest staking pool

The solutions offered by Rocket Pool and Lido are somewhat different, and the former’s products are built for node operators, Beacon Chain validators, and ordinary stakers.

Rocket pool differs from Lido Finance in that: 1) Rocket is more decentralized; 2) Rocket now only supports the ETH ecosystem, while Lido is open to many other PoS ecosystems, including ETH2.0, LUNA, SOL, and KSM. In addition, Lido will soon support MATIC as well.

For more details about the pool, please refer to our previous article:

https://medium.com/@ViaBTC_Capital/viabtc-capital-insight-liquid-staking-is-unleashing-the-assets-value-and-efficiency-3de47f5a894d

1.Cross-rollup infrastructures

Although the market abounds with cross-chain projects, it lacks cross-rollup tools. Not many people have noticed this field, and DApps that bridge the gap between Optimistic Rollup and ZK-Rollup will enjoy brilliant market prospects.

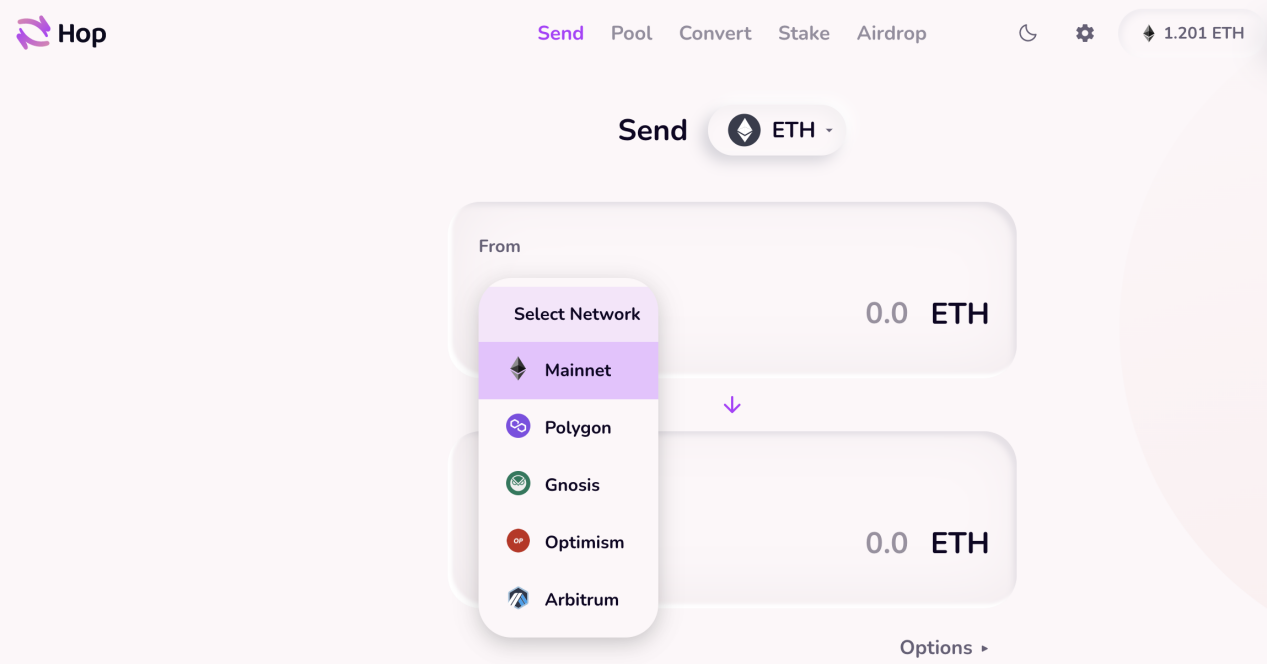

•Cross-Rollup DEX — Hop Protocol

(https://app.hop.exchange/#/send?token=ETH)

Hop Protocol is a Rollup token bridge, and Hop Exchange is a front-end application created on this bridge system. The rationale behind the project: Hop relies on market makers called Bonders, who earn fees by providing liquidity for others; this automated market maker (AMM) style allows Hop users to quickly send cross-chain transactions, which offers liquidity providers that plan to swap a great chance to earn profits!

•Decentralized Cross-rollup bridge — Orbiter Finance

Orbiter Financem, a solution that enables the transition from L1 to L2, now supports the low-cost, real-time mutual transfer of ETH and ERC-20 between zkSync, the ETH mainnet, Arbitrum, and Polygon. Mainnet link of the DApp: https://app.orbiter.finance/. Innovative features: From cross-chain to cross-environment, Orbiter Finance enables cross-rollup transfers and transfers from Rollup to Optimism.

•Other projects: Immutable X to launch a liquidity solution spanning multiple L2/L3 ZK-Rollups

The NFT Layer2 protocol Immutable X will team up with StarkNet to launch Cross-rollup, a liquidity solution that enables transfers across multiple L2/L3 ZK-Rollups. It aims to bring the scalability and composability of NFT to Web3 gamers.

4. Relay services

Rollups use Calldata, which is very expensive. On Ethereum, one of the most expensive operations is writing to storage. For Rollups like Arbitrum and Optimism, a network of bots that support bundled TXs (e.g. Argent and Zecrey) would be very helpful in keeping the cost down.

•Argent (https://www.argent.xyz/)

Argent, a Layer 2 wallet, allows users to easily and quickly transfer Layer 2 assets to Layer 1, with low costs. Additionally, a new version of Argent wallet has just been released. Compared with conventional wallets, Argent boasts some unique features:

1) Support for ENS-like domain name addresses (xxxxx.argent.xyz), with customizable prefixes;

2) The latest version supports zkSync, and expensive activation fees are no longer required;

3) Support for swap under zkSync, and L2 swaps are cheap via Argent.

•Zecrey (https://faucet.zecrey.com/)

Zecrey is a wallet that integrates cross-chain functions, privacy-preserving attributes, and Layer2 features. It moves across multiple public chains, covering ETH, BSC, Polygon, AVAX, and Aurora. With Zecrey, you can 1) manage multi-chain assets in your L1 wallet; 2) engage in privacy-preserving L2 transactions; 3) lock and unlock multi-chain assets for profits; 4) swap and add/delete liquidity in your L2 AMM DEX; 5) transfer assets by depositing and withdrawing cryptos between L1 and L2.

5. Streaming payments

The expansion of Layer 2 will lay the path for the true growth of L2-native DApps. Solutions like streaming payment projects will shine. Once they become widely adopted, users will flock to these solutions that promise convenient, efficient, low-cost user experiences. Streaming payment protocols (e.g. Sablier.Finance) are not just tools but infrastructures through which developers can build a variety of DApps and apply them in such fields as DeFi, IDO, NFT, AirDrop, DCA, Automatic Investment Plan, DAO, and Web3.

Sablier.Finance (https://sablier.finance/)

Sablier is a streaming payment application that allows funds to be withdrawn between multiple parties in real time or at small intervals (measured in seconds). With plenty of use cases, once Sablier gains extensive adoption, the project will revolutionize the entire Web3 world. Sablier can be used for real-time payrolls, real-time airdrop distribution, real-time token ownership, new models of token issuance, fixed investment/DCA (buy or sell), real-time dividends for NFT holders, etc.

6. Multi-chain governance

As multiple blockchains and PoS public chains keep growing, the collaborative development between them will give birth to useful cross-chain DAO tools and collaboration tools. For instance, there could be a project that enables the interoperability of PoS networks. It would link the Ethereum PoS network with other public chain networks to facilitate multi-chain growth and turn other chains into Ethereum shards that coordinate with the Ethereum mainnet.

For instance, there might be more space for Layerzero/Axelar to flourish. For more details, please refer to:

https://medium.com/@ViaBTC_Capital/viabtc-capital-insight-can-interoperability-protocols-change-the-cross-chain-market-7f79888abc30

In our view, it is a challenge to convince people to accept such DAO workflows. Also, zero-knowledge proof and blockchain should be combined. Plus, the recognition and confirmation of people’s works should also be designed and coordinated. Such a project, coupled with efficient DAO management tools and other crypto tools, might easily flourish. For example, Dework (https://dework.xyz/) is a Trello+Resume project delivered in the form of Web3. It enables the productivity management of the contributor economy, creates bounties for contributors to build their Web3 profiles, and allows you to pay with your own DAO tokens.

7. Privacy

Vitalik Buterin, Ethereum’s co-founder, often says that he would like to see private transactions on Ethereum, but the closest thing so far is mixing services for anonymizing funds, such as Tornadocash. That said, these are not strictly private transactions. As Ethereum focuses on scaling, such transactions are unlikely to appear at the basic layer (the foundation of the protocol) anytime soon, but perhaps real privacy can be achieved through smart contracts that prioritize private transactions at Layer 2. For instance, Aztec.network, which is built on top of PLONK, is a new, improved standard when it comes to general-purpose SNARK technology. It keeps your identity, crypto balance, and codes private.

8. Counterfactual wallets

Counterfactual wallets allow users to directly use ETH in L2 while avoiding the high gas fees arising from their original L1 holdings. This technology will be adopted by top CEXs and DeFi protocols to bring in massive new users.

9. Interchain accounts

Many PoS blockchains, such as Cosmos, have been quietly working on the cross-chain future. Interchain accounts will allow different blockchains to easily interact with all smart contracts on ETH, which will help unlock billions in capital.

This April, Theta quietly announced an upgrade, which marks the official launch of interchain accounts, a module that may boost the interoperability, capacity, and composability of blockchain networks. Interchain accounts enable cross-chain communication and chain-to-chain interactions. They grant blockchains the power to open up their native functionalities as an “API” or service endpoints to be called by another chain in a customizable manner. They then execute the calls to these endpoints over the interchain account channel. In short, interchain accounts allows one blockchain to write state on another.

10. Multi-language clients

1) Lodestar: the TypeScript Ethereum Consensus client

https://lodestar.chainsafe.io/

Lodestar is an open-source Ethereum Consensus (Eth2) client and Typescript ecosystem, maintained by ChainSafe Systems. Right now, it provides nodes and clients with three major functions (under testing):

•BLS Keygen: The function is used to generate/restore master BLS keys (Specs: EIP-2333, EIP-2334, and EIP-2335) and derive children BLS keys, with Eth2 web utility for deriving children BLS keys from a master BLS key, which are then encrypted and bundled together in a downloadable format for use in Eth2 testnets.

•Simple Serialize

The function is used to serialize and deserialize common types of SSZs. It is a serialization and merkleization standard created specifically for Ethereum consensus.

•ENR App (Ethereum Node Records)

EIP-778 defines Ethereum Node Records, an open format for p2p connectivity information. Node records improve cryptographic agility and the handling of protocol upgrades.

2) Prysmatic Labs’ Prysm

Prysm is a full-featured implementation for the Ethereum PoS protocol written entirely in the Go programming language. As the client with the largest user base, the project contains a full Beacon Chain node and a validator client for participating in blockchain consensus. Prysm uses the most advanced tools for production servers and inter-process communication.

3)Lighthouse

https://github.com/sigp/lighthouse

Lighthouse is an open-source Ethereum consensus client written in Rust and made available under the Apache 2.0 license. Lighthouse was jointly funded and built by Sigma Prime, an information security and software engineering company, the Ethereum Foundation, Consensys, and individual developers.

4)Nimbus

Nimbus is a client implementation that strives to be as lightweight as possible in terms of resources used. This allows it to perform well on embedded systems, resource-restricted devices, including Raspberry Pis and mobile devices, and multi-purpose servers. Resource-restricted hardware is not the only thing Nimbus is good for. Its low resource consumption makes it easy to run Nimbus together with other workloads on your server, which is especially valuable for stakers looking to lower the cost of their server instances.

Nim is an efficient, general-purpose system programming language with a Python-like syntax that can be compiled to C language.